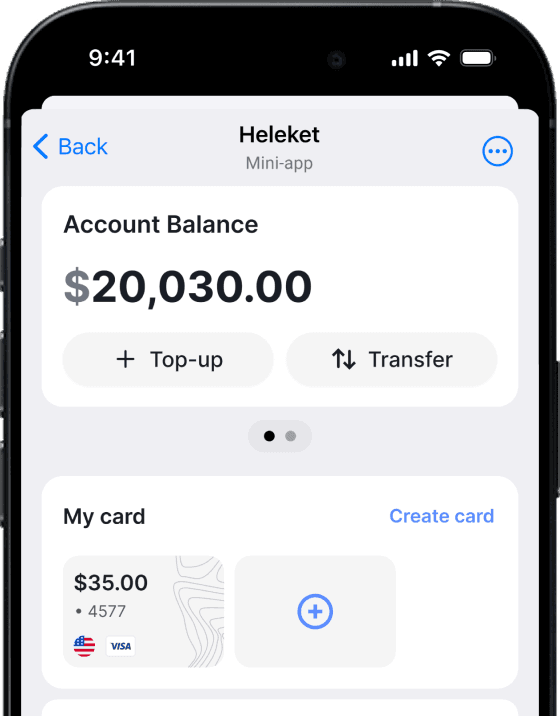

Instant application. Global opportunities.

Top up your balance with cryptocurrency

Quick top-ups, instant crediting - it's all simple.

Issue a virtual card

Receive your details immediately after issuance - no long waits or unnecessary steps.

Start paying for services worldwide

Pay without limits for subscriptions, hosting, AI, games, and any other foreign services.

Everything you need for comfortable payments

We carefully monitor payment security and are always available to assist you with any questions.

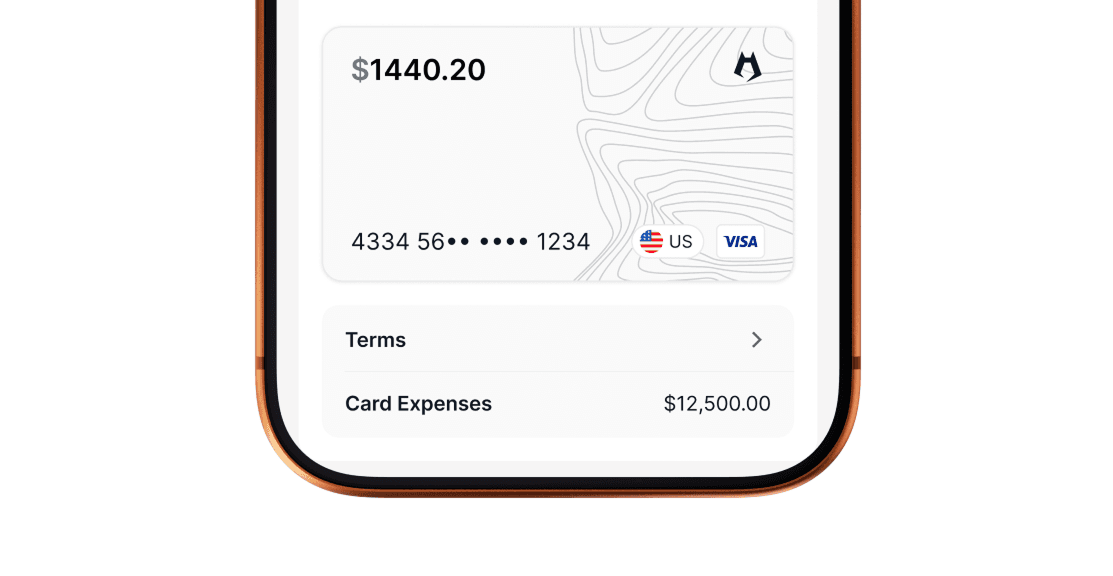

Unlimited payments

Pay for foreign services and subscriptions without limits or blocks. Top up your card with cryptocurrency and use it from anywhere in the world.

Low fees

Top up your card with cryptocurrency at minimal fees. All major coins are supported - fast, convenient, and profitable.

Coming soon

Support for Apple Pay and Google Pay

Add your card to Apple Pay or Google Pay and pay instantly - online, in apps, and offline.

Pay securely with 3D-Secure

Cards work with all services that require two-factor authentication.

Get your card instantly

Apply for a virtual card in just a few clicks from home. No trips to the bank or long waits.

Verified by over 3000 users

One card - for everything you love

Get a virtual card and pay for services, games, and subscriptions worldwide in just a couple of clicks, without unnecessary steps or restrictions.

Latest blog posts

The Latest industry news, interviews, technologies and resourses

Frequently Asked Questions

Everything you need to know about the product and its capabilities

What is a virtual card and how does it differ from a regular plastic card?

How quickly is a Heleket virtual card issued?

Where can I use your virtual card (what purchases and services is it suitable for)?

Can I add the virtual card to Apple Pay or Google Pay for contactless payment in stores?

Can I withdraw cash from a Heleket virtual card at an ATM?

How secure is your virtual card for online payments?

What should I do if my virtual card details become known to third parties?

How do I top up the balance of my Heleket virtual card?

Are there any limits or restrictions on operations with your virtual cards?

Can I issue a virtual card for just one transaction?

Let’s keep in touch!